Rating Advisory

Credit Rating has always been the subject of great importance especially for large and mid corporate. The matured international capital & debt market heavily depends upon credit rating of the issuer/borrower to support their investment decisions and thereby the rating becomes the key to the access to these markets. It’s an opportunity to an issuer to diversify ways of funding and strengthening the financial flexibility with an option of pricing of its debt.

The credit rating carries with them a great practical importance for the business enterprises, not only it impacts the cost of the funds, the financing structure but also limits its ability to continue with the business;

Hence, a business enterprise should carefully consider the impact on the credit rating every time they make a significant financial and strategic decision.

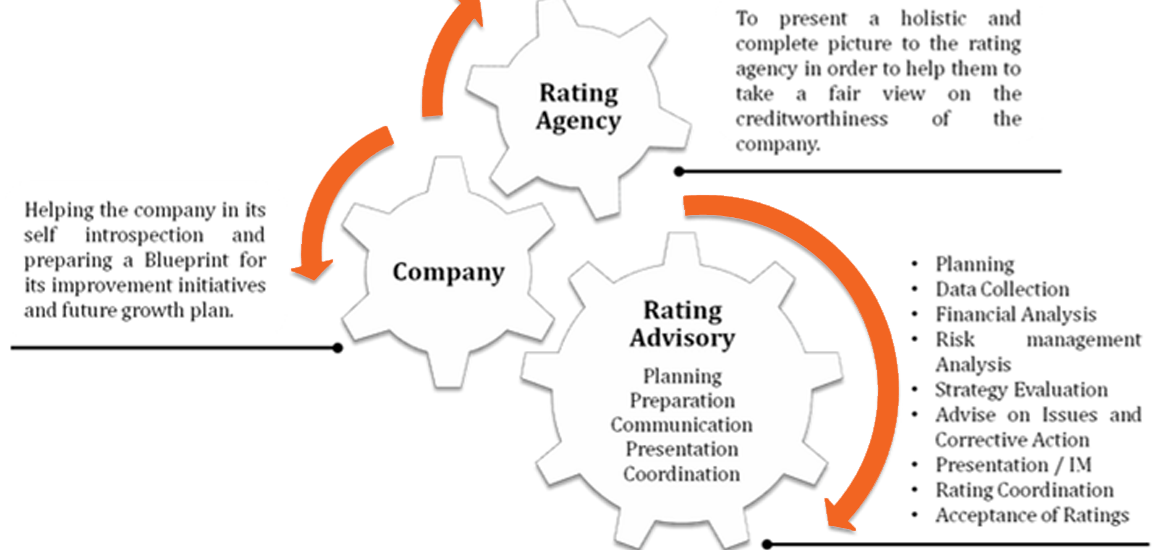

TFS provides companies with expert guidance to optimize their ratings. TFS with its in-depth understanding and knowledge, experience and exposure on subject like strategic management, financial management , business consulting offers their client an end-to-end solutions and help, right from preparing the company for rating to the final assessment by the independent rating agency and optimization of the rating